The image of smiling Auctioneer Oliver Barker the Lucian Freud “Head of a Boy” held by a white gloved attendant at his left side which fetched £5.7 million.

Sotheby’s London season opener contemporary art evening sale though absent of masterpieces, nevertheless delivered rock solid results of £93,295,300/$122,953,876.

Only six of the 66 lots offered failed to sell for a crisp buy-in rate by lot of 9 percent.

The result, including fees, traveled towards the high end of pre-sale expectations of £76.9-106.5/$99.4-137.7 million.

Estimates do not include the buyer’s premium.

The hammer total (before fees) was £77,925,000/$102,697,358, a bulls-eye hitting the low end of the estimate spectrum.

The tally lagged behind last March’s £109.3/$151.6 million result for the 55 lots that sold.

Twenty-nine of the 60 lots sold for more than one million pounds and of those, five exceeded five million pounds while dollar wise, 33 exceeded one million dollars and of those, six hurdled the five million dollar mark.

At least 26 of the 60 lots that sold, including most of the top lots, came to market backed by financial guarantees, either in the form of outright guarantees by Sotheby’s or in combination with anonymous third parties (coined “irrevocable bids” by the auction house) that receive a financing fee for their troubles.

The numbering is tricky since a number of the deals are made at the 11th hour, long after the auction catalogue has gone to press with the various guarantee symbols telegraphing those lots.

Every lot reported sold here includes the hammer price plus the buyer’s premium tacked on for each lot sold and calculated at 25 percent of the hammer price up to and including £300,000, 20 percent of amounts in excess of that and up to and including £3 million and 13.9 percent of any amounts in excess of that figure.

Sotheby’s buyer’s premium currently is the highest in the industry.

Rebecca Warren, Fascia III, 2010, est. £250,000-350,000

The evening got off to a strong start with Rebecca Warren’s voluptuously shaped bronze, “”Fascia III” from 2010 and hailing from an edition of six plus two artist proofs shot to a record £555,000/$731,434 (est. £250-350,000).

Jenny Saville’s ‘Juncture’ (Estimate £5,000,000-7,000,000) is pictured at Sotheby’s on March 01, 2019 in London, England. Sotheby’s Contemporary Art Evening Sale takes place on March 5th, at 7pm. (Photo by Tristan Fewings/Getty Images for Sotheby’s)

A few lots later, Jennie Saville’s monumental backside of a female nude, “Juncture” from 1994 and scaled at 120 1/8 by 66 ¼ inches sold to a telephone bidder for £5,442,200/$7,172,275 (est. £5-7 million).

It last sold at Christie’s London in February 2009 for £457,250 and this time round came backed by a third party “irrevocable bid.”

Women artists were much in evidence in Sotheby’s line-up, with 13 making the evening cut, a record in itself, according to the auction house.

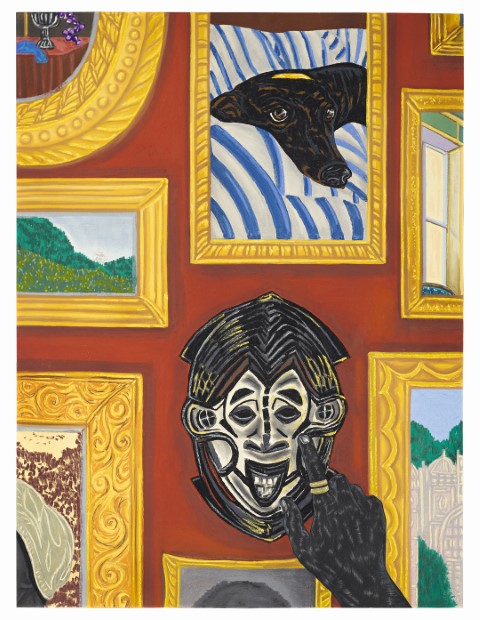

Toyin Ojih Odutola, Selective histories, 2016, est. £100,000-150,000

Of those entries, Nigerian artist Toyin Ojih Odutola’s complex and richly layered figurative work in charcoal, pastel and pencil on paper, “Selective Histories” from 2016 attracted strong bidding and sold for a record £250,000/$329,475 (est. £100-150,000)

Agnes Martin’s almost invisible abstraction, “Untitled #9” from 1994 and bearing her signature Minimalist aesthetic, realized £2,775,000/$3,657,172 (est. £1.8-2.2 million), going to a telephone bidder.

The seller acquired the then primary market work from Pace Gallery in 1995, a time when it was known as Pace Wildenstein.

Lucian Freud, Head of a Boy, 1956, est. £4,500,000-6,500,000

As for British entries, Lucian Freud’s petite, 7 by 7 inch oil on canvas, “Head of a Boy” from 1956 and framed in such a fashion to seemingly squeeze the lad’s handsome head, sold for a hefty £5,779,100/$7,616,276 (est. £4.5-6.5 million).

It was acquired by the late seller, the Honorable Garech Browne, the same year it was painted.

David Hockney’s Los Angeles themed landscape, “Different Kinds of Water Pouring into a Swimming Pool, Santa Monica” from 1965 and executed in acrylic on canvas and trophy sized at 72 /18 by 60 inches, made £2,715,000/$3,578,098 (est. £2,5-3.5 million).

It last sold to tonight’s seller Louis J.C. Tan at Sotheby’s New York in May 1989 for $506,000,

Howard Hodgkin’s color saturated abstraction, “Counting the Days” from 1979-82 and executed in oil on wood panel and frame, made £747,000/$984,471 (est. £300-500,000).

Tan acquired it at Sotheby’s New York in November 1989, at the height of that decade’s art boom for $440,000.

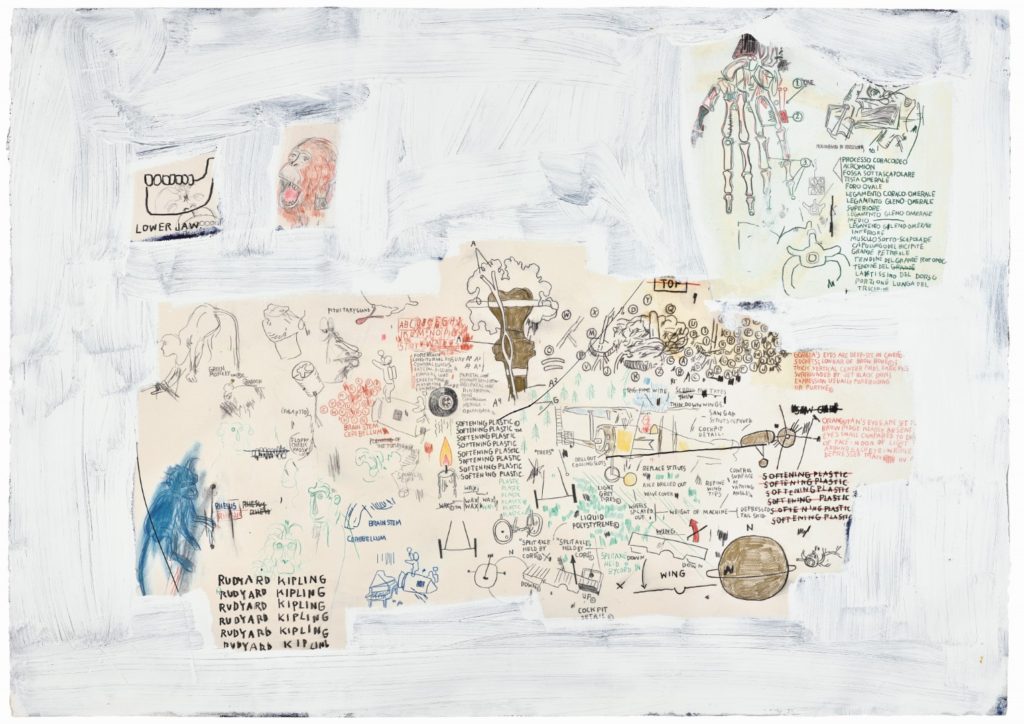

Other high netting works from the Tan collection included two Jean-Michel Basquiat medium scale works on paper in mixed media and Xerox collage, with “Untitled” 1987, crowded with anatomical renderings and text going to a telephone bidder for £1,125,000/$1,482,638 (est. £300-400,000) and “Untitled” from the same year, similarly packed with anatomical drawings and [lot 52] in this one, mysterious references to Rudyard Kipling, that made £1,005,000/$1,324,490 (£400-600,000).

Tan bought the first one at Christie’s London in May 1992 for $30,800 and the second at Christie’s London in March 1993 for £18,400.

It sure helps to get in the game early!

Jean-Michel Basquiat, Untitled, 1987, est. £400,000-600,000

Apart from the Tan entries, Basquiat also took away the top lot with another late work, “Apex” from 1986 and executed in acrylic, oilstick, and Xerox collage on canvas and depicting a fierce looking, dreadlock coifed figure as well a skeleton scull that attracted at least a trio of bidders and sold to the telephone for £8,227,950/$10,843,615 (est. £5-7 million).

It was also backed by an irrevocable bid and did surprisingly well given that late Basquiats (the artist died in 1988) are usually considered worn-out and overly drug freighted.

It last sold at auction at Christie’s London in June 1988, the very year the artist died, for £16,500.

Other notable lots included Gerhard Richter’s 70 7/8 inch square formatted and squeegee stroked “Abstraktes Bild” from 2009 that came to market free of any guarantee and sold to a telephone bidder for £6,918,100/$9,117,364 and Adrian Ghenie’s evocatively titled and figurative blockbuster, “Duchamp’s Funeral 1” from 2009 that sold to another telephone bidder for an estimate topping £4,298,400/$5,664,861 (est. £2.5-3.5 million).

It last sold at Sotheby’s London in October 2014 for £1,022,500.

On a New Yorker note, storied fashion designer Marc Jacobs sold off a small trove of works, all of them backed by guarantees, including [lot 42] Gerhard Richter’s blurry, photo-realist composition, “Sabelantilope (Sable Antelope)” from 1966 and executed in oil on canvas that sold to a telephone bidder for £1,215,000/$1,601,248 (est. £1-1.5 million).

Jacobs bought it at Christie’s New York in May 2014 for $1,685,000, taking a tiny loss, at least on paper from the investment.

The evening action resumes on Wednesday at Christie’s Post-War and Contemporary Art auction.