Oliver Barker auctionerring Jean-Michel Basquiat’s ‘Black’, credit Michael Bowles, Getty

The so-called hybrid digital live stream model of art auctions invented out of necessity from the Covid pandemic, soldiers on as evidenced by the twin sales of Contemporary and Impressionist and Modern sales at on October 28 that realized a combined sum of $283.9 million.

A thirty minute ‘pre-game’ highlights program starring culture vultures Kurt Anderson of NPR and Adam Gopnik of the New Yorker wandering the mostly empty headquarters of Sotheby’s York Avenue fortress and hearing about the top lots from various specialists proved mildly entertaining.

The contemporary evening sale kicked off at 6 PM with mellifluous auctioneer Oliver Barker fielding online and telephone bids from his post in London and telegraphed by specialists and client service types there as well as New York and Hong Kong.

Thirty-nine of the 41 lots offered realized $142.8 million, including fees, with just two unsold lots, falling midway between pre-sale expectations of $128.2 -184.3 million.

Thirty-nine of the 41 lots offered realized $142.8 million, including fees, with just two unsold lots, falling midway between pre-sale expectations of $128.2 -184.3 million.

For comparison sake, last November’s contemporary art live auction at Sotheby’s New York realized $270.6 million for 46 lots sold.

Estimates do not include the buyer’s premium which is charged for each lot sold and calculated at 25% of the hammer price up to and including $400,000, 20 percent of anything above that and up to and including $4 million and 13.9& for anything over that sum.

In addition a one percent “enhanced premium” of the total hammer price is tacked on for a little more operating juice for Sotheby’s.

There was also plenty of pre-auction insurance gathered with 23 of the 39 works that sold backed by third party or house guarantees.

Significantly, two major works scheduled to sell as deaccessioned items from the Baltimore Museum of Art were withdrawn at the 11th hour, namely Brice Marden’s calligraphic composition “3” from 1987-88 estimated at $10-15 million and Clyfford Still’s jagged abstraction “1957-G” from 1957 estimated at $12-18 million.

The reason? According to the BMA statement, “The decision was made after having heard and listened to the proponents and the detractors of the BMA’s Ambitious Endowment for the Future and after a private conversation between the BMA’s leadership and The Association of Art Museum Directors.”

A third BMA work, Andy Warhol’s forty foot wide “Last Supper” from 1986 and offered privately by Sotheby’s in excess of $40 million is understood to still be in play.

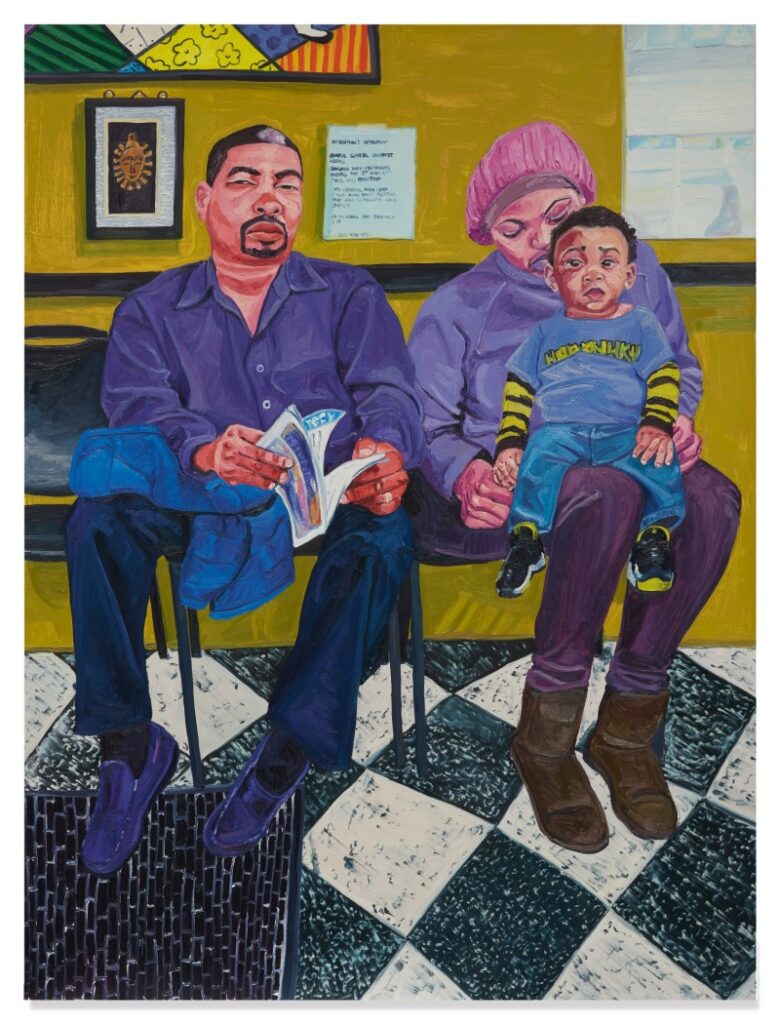

Jordan Casteel, Barbershop, 2015, oil on canvas, 72 by 54 inches (182.9 by 137.2 cm)

The long evening got off to a promising start with the young figurative painter Jordan Casteel’s “Barbershop” from 2015, featuring a seated couple with their young child perched on his mother’s knee making $564,500 (est. $400-600,000) and the recently deceased Matthew Wong’s startling landscape, “Dialogue” from 2018 hitting $1,677,700 (est. $200-300,000).

Lynette Yiacom-Boakye, Figure of Eight, 2015 on the reverse, oil on canvas , 78 by 51 inches (200 by 130 cm)

In another figurative vein, Lynette Yiadom Boakye’s solitary “Figure of Eight” from 2015, depicting a bathing suit clad woman and large-scaled at 78 ¾ by 51 ¼ inches, sold for $786,500 (est. $600-800,000).

It came to market backed a so-called irrevocable bid, more simply known as a third party guarantee.

Alexander Calder, 1955, Sumac 17, sheet metal, wire and paint, 41 x 75 x 39 inches. (105.7 x 192 x 100 cm)

Price points quickly jumped to seven figures with Robert Ryman’s strikingly minimal “Branch,” in oil on canvas with four painted steel fasteners and bolts from 1980 that made $5,447,987 (est. $4-6 million).and Alexander Calder’s stunning and red leafed “Sumac 17” mobile from 1955, executed in sheet metal and wire, that brought $8,327,979 (est. $6-8 million).

It last sold at Christie’s New York in May 2016 for $5,765,000.

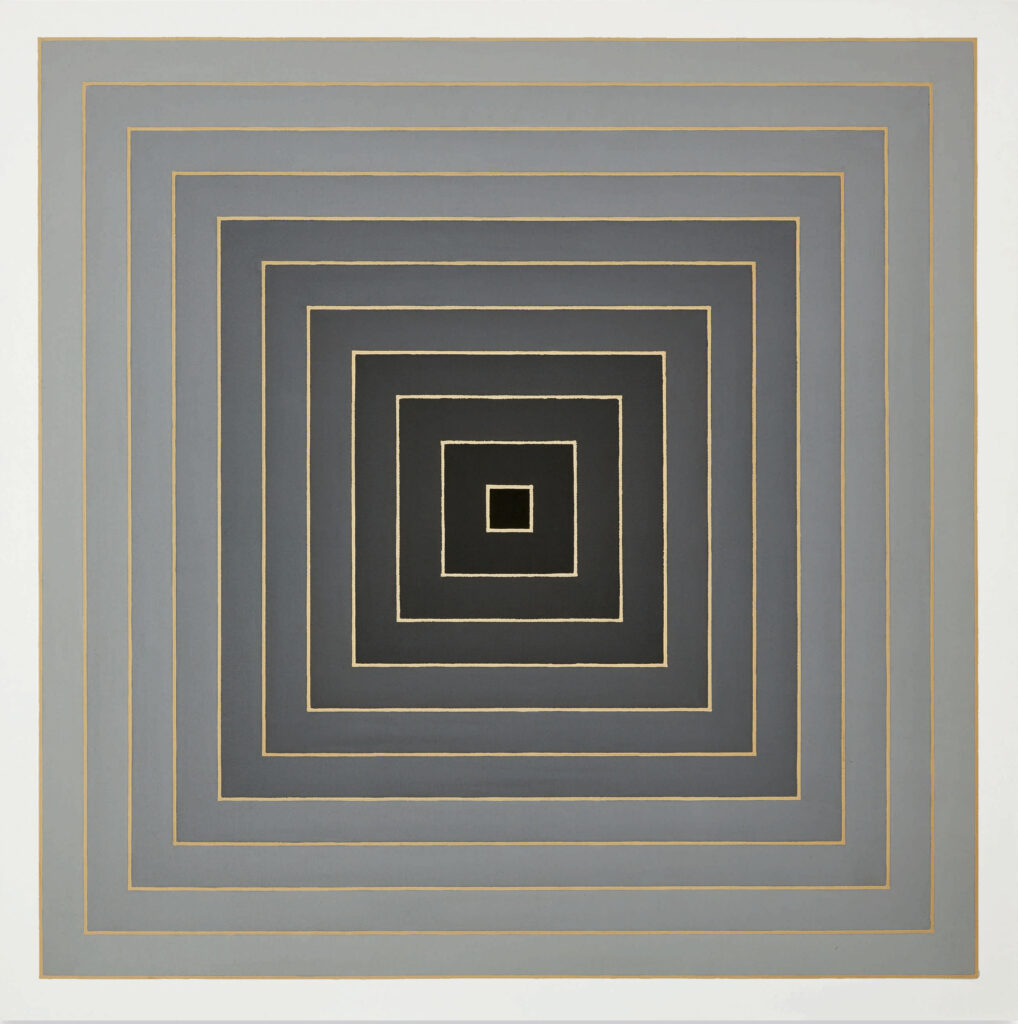

Frank Stella, Untitled, 1968 on the overlap, acrylic and graphite on canvas, 68 x 68 inches (174.9 by 174.9 cm)

In that same blue vein, Frank Stella’s concentric square composition, “Untitled” from 1968 in acrylic and graphite on canvas and scaled at 68 7/8 by 68 7/8 inches brought $8,097,580 (est. $5-7 million), one of the few works in the sale that hurdled its high estimate.

Mark Rothko, Untitled (Black on Maroon), 1958,

oil on canvas, 72 x 45 inches (182.9 by 114.3 cm)

That trajectory didn’t last long as the sale’s most expensive entry, Mark Rothko’s darkly luminous “Untitled (Black on Maroon)” from 1958 and dutifully listed in David Anfam’s Rothko catalogue raisonne as no. 618, crashed out at a $24 million bid (est. $25-35 million).

It last sold at Christie’s New York in May 2013 to dealer Dominique Levy for a rousing $27 million (est. $15-20 million).

One might ask, is this the canary in the coalmine re a softening of certified blue chip works or a picture too sophisticated for current tastes?

At any rate, the catalogue note indicated Sotheby’s had a financial interest in the picture, so it may bounce back to the auction block sometime in the hazy future.

Better news greeted a pair of late Jean-Michel Basquiat paintings from the estate of the late Basquiat champion and catalogue raisonne publisher Enrico Navarra as ”Black” from 1986, executed in acrylic, oil, graphite, crayon and Xerox on wood boxes sold for $8,155,179 (est. $4-6 million) and “Jazz” from the same year and comprised of similar elements and plenty of jazz related text, made $6,945,583 (est. $4-6 million).

Jean-Michel Basquiat, 1986, “Black”, acrylic, oil, graphite, crayon and Xerox on wood, 49 x 36 x 11 inches (126.4 by 92.7 by 29.2 cm)

Not surprisingly, given the difficulty of sourcing material in Covid plagued times, the sale also included items in categories apart from painting and sculpture, as evidenced most impressively by Carlo Mollino’s magnificent and unique dining table in molded plywood, maple, brass and glass from 1950 and deaccessioned by The Brooklyn Museum. It fetched, after a marathon, ten minute long bidding battle, a record $6,196,785 (est. $2-3 million).

Carlo Mollino, Dining Table, molded plywood, maple, brass, and glass

30 x 98 x 31 inches (77.2 x 250.1 x 80 cm), Designed in 1949, executed in 1950 by Appelli & Varesio, Turin, Italy

The table came to market backed by an irrevocable bid, making an undisclosed finance fee for the anonymous and lucky backer.

The sale also included a trio of Alfa-Romeo concept cars, known for their acronym B.A.T. (Berlina Aerodinamica Tecnica) #’s 5, 7 and 9 from 1953, 1954 and 1955.

All of the beautifully sleek cars were designed by Franco Scaglione with bespoke coachwork by Carrozzeria Bertone.

The trio, backed by an irrevocable bid, took top lot honors at $14,879,710 (est. $14-20 million).

a trio of Alfa-Romeo concept cars, known for their acronym B.A.T. (Berlina Aerodinamica Tecnica)

After a short break punctuated by horribly familiar elevator muzak, the action resumed under Barker’s command with 36 Impressionist and Modern works that all sold for a $141 million tally.

At least half of the roster was guaranteed, either by third parties or in tag-team combination with Sotheby’s.

Even so, the result in auction parlance is a “white glove” sale, where the auctioneer, like pitching a perfect game, is given a pair gloves for his mantle place.

The tally hit above the mid-range of pre-sale expectations pegged at $111-160 million before fees.

For comparison sake, last November’s evening sale at Sotheby’s York Avenue HQ brought $208.9 million for 42 lots sold.

Pablo Picasso, La Chouette en Colere, signed Picasso, painted and partially glazed ceramic, 11 5/8 inches, 29.5 cm, executed in 1953; this work is unique.

First up was Pablo Picasso’s delightful “La Chouette en Colore” from 1953, a painted and partially glazed ceramic owl perched 11 5/8 inches high that made $1,048,500 (est. $1-1.5 million), followed by another Picasso, the strong, head shot portrait of his wife and muse, Jacqueline Roque, “Tete de Femme” in gouache on paper from 1958 that sold for $2,440,000 (est. 41.8-2.5 million.

It came backed by an irrevocable bid.

Tamara De Lempicka, 1932, “L’Eclat”, Oil on panel, 14 x 10 inches (32.2 by 27 cm)

In that same insured vein, Tamara de Lempick’s “curly hair “L’Eclat” from circa 1932 and one of the works from the collection of the la Sandra Moss, the former actress, theatre producer and philanthropist. It sold for $3,408,000 (est. $3-4 million).

René Magritte, “L’ovation”, 1962, Oil on canvas, 35 x 45 inches (89 x 116 cm)

Surrealism took center stage with Rene Magritte’s visionary “L’Ovation” from 1962 and replete with the artist’s signature objets of sea, clouds and cinched curtains that hit $14,025,000 (est. $12-18 million).

Alberto Giacometti, “Femme Leoni”, 1958, Inscribed Alberto Giacometti, inscribed with the foundry mark Susse Fondeur Paris and numbered 3/6, Bronze, 65¾ inches (167 cm)

Sculpture played a starring role as Alberto Giacometti’s stellar and ultra-thin standing female nude, “Femme Leoni” from a 1958 bronze cast and number three from an edition of six, brought the top lot price of $25,984,132 (est. $20-30 million).

It was backed by an irrevocable bid.

The seller was identified by Jeremy Hodkin’s Canvas as distressed magnate Ron Perelman who was also the seemingly anonymous seller of another Giacometti, the nine-foot high bronze goddess, “Grand Femme Debout 1” from 1960, one of four iterations made for the unrealized commission for the Chase Manhattan Plaza in New York and that came to Sotheby’s this month as a private sale and so-called “sealed bid” process that went to the highest bidder for at least, if not more than $90 million.

Barker announced that it had sold but no price was given.

“Grande Femme Debout 1” last sold at Christie’s New York in November 1989 to real estate magnate Sheldon Solow for $4.95 million hammer. Perelman acquired it in 1993.

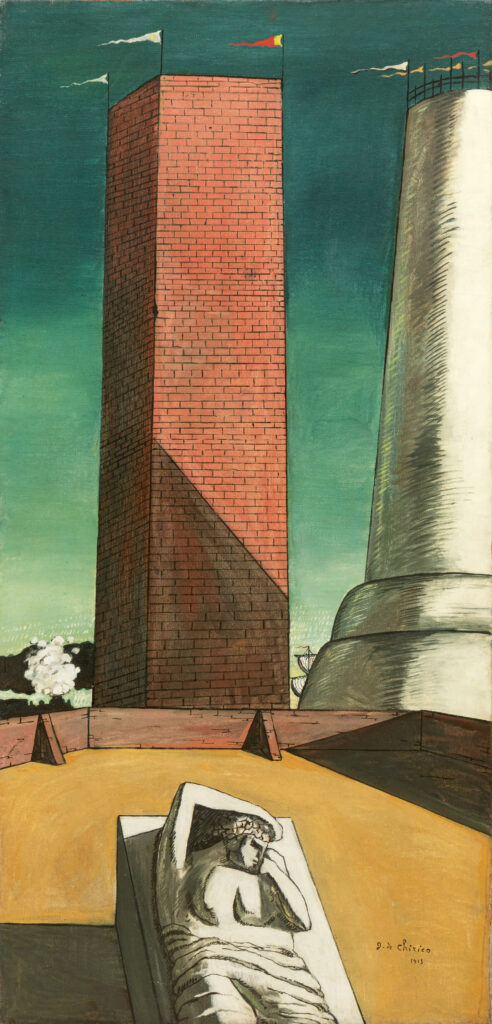

Giorgio de Chirico, Il Pomeriggio di Arianna (Ariadne’s Afternoon), 1913, oil on canvas, 53 x 25 inches (135.3 by 64.6 cm)

Back to the more public auction room (or broadcast studio as it were), the spectacular and rare Giorgio de Chirico canvas, “Il Pomeriggio de Arianna (Ariadnes’ Afternoon)” from 1913 and one of only eight canvases from this revered series sparked a bidding battle for the most exciting entry of the long evening and eventually fetched a record $15,890,400 (est. $10-15 million).

Vincent Van Gogh, “Fleurs Dans Un Verre”, 1890, Oil on canvas, 16 x 13 inches (41.3 by 33.3 cm)

Less dramatic but also bearing a mind-mending provenance trail, including a temporary ownership by the Nazi stolen art criminal Hermann Goering until it was recovered by the Monuments Men, was Vincent van Gogh’s beautiful still life, “Fleurs dans un verre” from 1890. It sold for $16,007,300 (est. $14-18 million) and was also backed by an irrevocable bid.

It last sold at Sotheby’s New York in May 2000 for $4.6 million.

With so many hybrid-staged sales elaborately staged by the duopoly of Christie’s and Sotheby’s as well as distant runner-up Phillips, one can say the market is certainly alive but still unsure as to how well.