Paul Cezanne’s snared the evening’s top lot with his gravity defying plate of fruit, “Nature morte de Peches et Poires” from 1885-1887 that fetched £21,203,750/$28,094,969

Though marred by a number of pricey buy-ins, Christie’s London combo single owner, Impressionist & Modern and Art of the Surreal evening auction on February 27 scored far higher than its arch-rival Sotheby’s & pulled in £165.6/$219.5 million. The tally easily trumped last February’s £113.8/$158.9 million result.

Fifteen of the 82 lots offered in the three separate catalogues failed to sell for a respectable buy-in rate by lot of 18 percent.

Even with fees tacked on, the group trailed the overall pre-sale estimate of £179.7-233.2/$238.1-$309 million. (Estimates do not include the buyer’s premium.).

Still, it ranks as the second highest tally for a London season in that category, which was set in February 2014 for a total £176,986,000.

Two auction records were set and along the way, six works sold for over £5 million and nine sold for more than $5 million.

Of those, four broke the $20 million mark.

In the financing deals overall, there were two house backed guarantees (meaning Christie’s assured the seller a minimum and confidential price no matter what the outcome) and a dozen others were covered by third party guarantees where the sellers are insured a minimum price by anonymous backers who receive deal by deal financing fees for the risks taken.

Both of the house guarantees failed to sell, leaving Christie’s as the new owner of the properties, an 1889 portrait by Giovanni Boldini estimated at £800,000-1.2 million and a garden landscape by Edouard Vuillard from 1911/1934 estimated at £600-800,000.

(The Vuillard, “Aux Pavillons a Cricqueboeuf Devant la masion” last sold at Christie’s New York in May 2004 for $903,500).

Christie’s transparently pointed out that the prices reported included the hammer price plus the buyer’s premium for each lot sold but “do not reflect costs, third-party financing fees or application of buyer’s or seller’s credits.”

In other words, you have to take the reported prices for ten of the works with a grain or two of salt.

Paul Cezanne’s snared the evening’s top lot with his gravity defying plate of fruit, “Nature morte de peches et poires” from 1885-1887 that fetched £21,203,750/$28,094,969.

As if it slipped off the plate, one rotund pear hugs the side of it, apparently anxious to rejoin his assembled comrades. In any event, it is a brilliant compositional device.

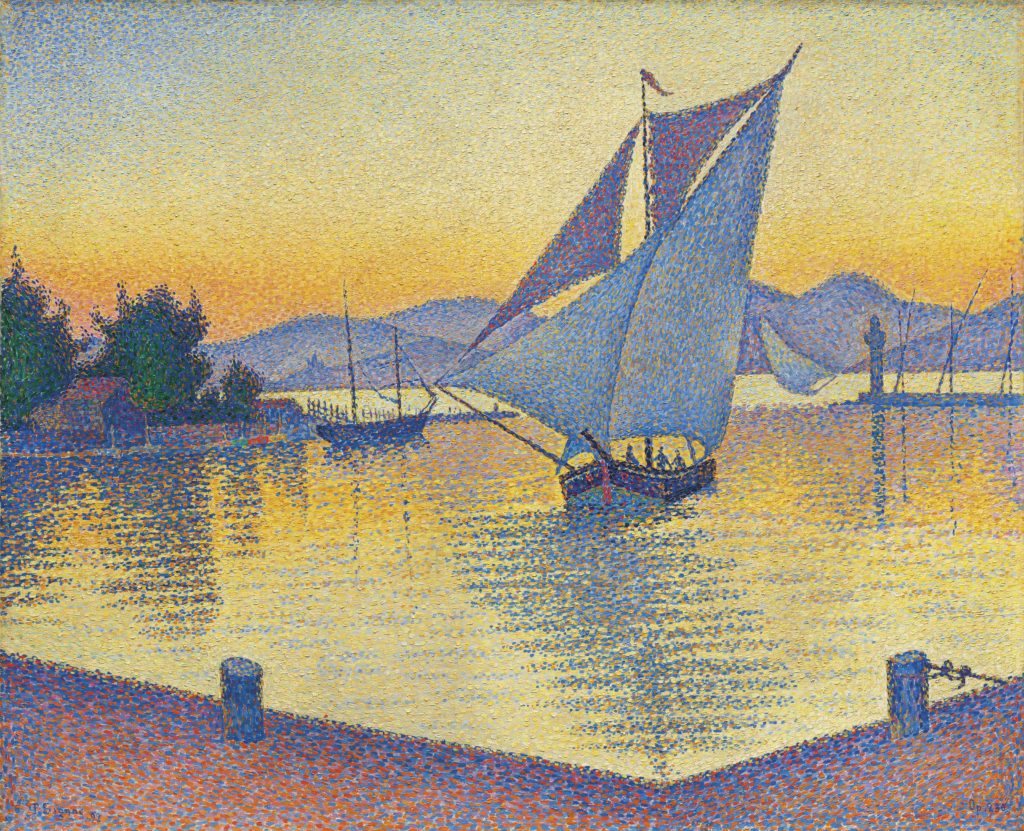

Paul Signac, “Le Port au soleil couchant, Opus 236 (Saint-Tropez)”

Not far behind in price, the Paul Signac sun kissed cover lot of the Impressionist & Modern catalogue, “Le Port au soleil couchant, Opus 236 (Saint-Tropez)” from 1892 replete with the chromatic pointillism of his idol, Georges Seurat, sold for an estimate busting and record £19,501,250/$25,839,156 (est. £13-18 million).

It last sold at auction at Sotheby’s New York in May 1993 for what seems now like a steal at $1,817,500.

Gustave Caillebotte, “Chemin Montant”

A second record was set for Gustave Caillebotte’s stunning scene of a strolling couple, “Chemin Montant” from 1881 that doubled the low estimate (with fees) and realized £16,663,750/$22,079,469 (est. £8.5-10 million).

It last sold at Christie’s New York in November 2003 for $6,727,500 (est. $6-8 million).

The painting, out of the public eye for over a century, had re-emerged at the Caillebotte retrospective at the Galeries Nationales du Grand Palais in Paris in 1994, a cause for art historical celebration.

Rene Magritte, “Le lieu commun”

A headliner in the Art of the Surreal portion of the evening, Rene Magritte’s fantastical cover lot, “Le lieu commun” from 1964, featuring two views of a bowler hatted gentleman separated by a slice of forest and ambiguous, pink tinted columns, brought £18,366,250/$24,3535,281 (est. £15-25 million).

Commissioned by Belgian casino magnate and collector Gustave Nellins at the time of Magritte’s massive mural decoration at Nellins’ Knokke casino (executed by anonymous artisans), the gentleman in black stands as a cipher for the artist’s mysterious imagery.

Since that time and after an undated sojourn at the Fuji Museum, the painting has entered two private Asian collections.

The weakest part of the evening was the separate catalogue, “Hidden Treasures-Impressionist and Modern Masterpieces from an Important Private Collection” that was unhappily riddled with a half-dozen buy-ins, including the cover lot Claude Monet that was saddled with an unpublished estimate in the ambitious region of £40 million.

Though massive and trophy like at 78 ½ by 70 3/4 inches and painted in Giverny in 1916-1919, “Saule pleureur et basin aux nympheas” bears a stamped signature, meaning the late painting never left the artist’s studio, at least during his lifetime.

In today’s usually sophisticated and demanding market that means the painting is not A+ but some grade below.

The casualties in this opening section of Christie’s evening may have been offset by house or third party guarantees, but there were none.

Looking back at the two recent evenings, Mary Hoeveler, a New York based art adviser who bought Man Ray’s large-scaled “Femmelaharpe” from 1957 at Sotheby’s £87.7/$115.3 million sale on February 26 for £1,575,000 (est. £700,000-1 million), observed, “the bidding was quite thin throughout. Asian bidding save the Sotheby’s sale but was not as evident at Christie’s. “

“In general,” continued Hoeveler, “the quality of the material dictated the interest levels. As The “Hidden Treasures’ sale demonstrated with its many passed lots, offering day sale material in an evening sale—even if bolstered by important works—was not a winning strategy. From that standpoint, and in spite of its lower tally as compared to other years, Sotheby’s much smaller sale was nevertheless better managed, with its tighter, more edited line-up.”

The evening action in London switches to contemporary art at Sotheby’s tomorrow, March 5th.