Henry Moore’s Reclining Figure: Festival, 1951, took top honors at Christie’s, going for an artist- record $30.1 million

Impressionist and Modern Art

Aside from a few high-profile flops that the houses stumbled Over, the February sales of Impressionist and modern art delivered healthy results that overall seemed to reassure a market still jittery from euro zone woes.

On February 7, the total take at Christie’s easily hurdled presale expectations and squashed last February’s £84.9 million ($136.3 million) result. The top slot went to a sleeper, Henry Moore’s weighty bronze Reclining Figure: Festival, 1951 (est. £3.5-5.5 million; $5.5-8.7 million). The Cologne-based dealer Alexander Lachrnann, who has a heavily Russian clientele, calmly out- gunned two anonymous telephone bidders to claim the prize for £19,081,150 ($30.1 million). The price crushed the previous Moore record of

£4.3 million ($8.5 million), set for Draped Reclining Woman, 1957-58, at Christie’s London in June 2.008, and also bested the $9 million asking price on another cast from the edition of five, offered last summer at the Masterpiece fair. The consignor, New York real estate magnate Sheldon Solow, had acquired the piece at Sotheby’s New York in May 1994 for $2.0 million. Solow also made a jumbo profit on the outstanding Joan Miro canvas Painting-Poem, 1925 (est. £6-9 million; $9.5-14.2 million). Despite a relining that had eliminated important writing by the artist on the back, the painting- which Solow picked up for $770,000 at Christie’s New York in 1985-attracted at least four bidders, including New York dealer William Acquavella, who bagged it for an artist-record £16,841,250 ($26.6 million), the highest price in the Art of the Surreal portion of the evening.

Christie’s had high hopes for Juan Gris’s Le livre, 1914-15 (est. £12-18 million; $18.9-18.4 million), a Cubist abstraction whose zingy color scheme seemed tailor-made for current tastes. It squeaked by at £10,345,150 ($16.3 million), one of the house’s few overreaches. Giovanna Bertazzoni, head of the London Impimod department, says, “We were super rigorous on the estimates. We learned a lot from the November sale in New York,” referring to that sale’s 38 percent casualty rate.

Claude Monet’s L’entree de Giverny en hiver, 1885, fetched $13.1 million at Sotheby’s

The following evening, in a reversal of last fall’s results, it was Sotheby’s that had a tougher time, realizing nearly 40 percent less than its rival. Still, the £78,837,65o ($12.5.4 million) tally nicked the low end of presale expecta- tions and came out ahead of last year’s £68.8 million total.

The first bump in the road came when the cover lot, Gustav Klimt’s symbolist landscape Seeufer mit Birken (“Lakeshore with Birches”), 1901, which had been in the same family since 1902 and was estimated to earn at least £6 million ($9.4 million), withered on the vine at £3.8 million. The consignors sat shell-shocked, facing the unhappy prospect of returning home with a burned picture, but the canvas was rescued via offers later in the evening from three bidders who had sat on their hands earlier. The family finally accepted a £5,641,150 offer ($8,974,100 after the buyer’s premium). Auctioneer Henry Wyndham’s announcement of the deal seemed to improve the mood in the room; officially, however, the Klimt was excluded from the final tally.

A handful of lots managed to build momentum and reap respectable prices, including Claude Monet’s shadowy snow composition, L’entree de Giverny en hiver, 1885 (est. £4.5-6.5 million; $7.1-10.3 million), which took the top slot at £8,217,150 ($13.1 million). Not far behind was Ernst Ludwig Kirchner’s Boskett: Albertplatz in Dresden, 1911 (est. £5-7 million; $7.9-11.1 million), which sold to a private European collector for £7,321,2.50 ($11.6 million). A fine Fauve-period Georges Braque, L’Oliveraie, 1907, soared to £5,081,z50 ($8.1 million), well above its top estimate of £3 million ($4.7 million), and a fantastic Otto Dix collage, Die Elektrische (“The Electric Tram”), 1919, made £2,953,250 ($4.7 million) against an estimate of £700,000 to 1 million ($1.1-1.6

million).

|

Christie’s |

Sotheby’s |

|

Impressionist and Modern and |

Impressionist and Modern |

A Tel Aviv-based art adviser who declined to give his name juiced the Surrealist market by snapping up four pictures for two clients, starting with Max Ernst’s La cornedie de la soil, 1941 (est.$1.9-2.8 million), for £1,609,250 ($2.6 million). The price reflects the recent vogue for Ernst; the same painting had fetched £748,000 on its last outing, at Sotheby’s London in June 2.007. The adviser’s final purchase was Joan Miro’s gestural late abstraction Personnage, 1973 (est. £700,000-1 million; $1.1- 1.6 million), for £1.1 million ($1.8 million).

But the sale’s main draw, a larger and earlier Peinture, 1933- which had been expected to bring in £7 million to £10 million ($11-15.8 million) -simply expired after a few halfhearted bids at £6.4 million, causing an audible chorus of gasps in the salesroom. Sotheby’s specialist Andrew Strauss was at a loss to explain. “It just didn’t have its night,” he said after the auction. “I suppose [the composition] was a bit static, but it had all the language you want from a Miro.”

On the basis of the material, the Sotheby’s sale “was never going to have the same fireworks as Christie’s, but in the end they did very well,” offered one New York dealer in attendance. “There are moments of sheer unpredictability in the market and we saw it tonight, as we saw it at Christie’s.”

Contemporary Art

In sales the following week at Christie’s, Sotheby’s, and Phillips de Pury & Company, the contemporary category was dominated by many of the usual suspects and reached uniformly strong results.

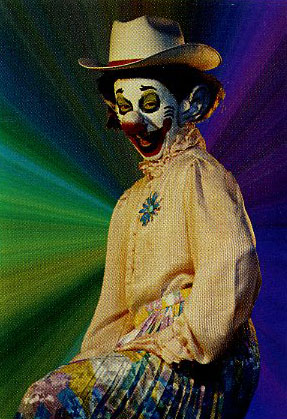

Cindy Sherman’s Untitled #410, 2003. realized $680,000 at Phillips de Pury, one of the highest prices for her clown series yet

On February 14th Christie’s notched its highest contemporary sale total in London since June 2008, powered by the most expensive lot of the season, Francis Bacon’s Portrait of Henrietta Moraes, 1963 (est. £15-20 million; $23.7-31.6 million). This sizzling, large-scale depiction of a reclining female nude was pursued by a posse of phone bidders before selling to one of them for £21,311,250 ($33.5 million). But deep-pocket bidding was felt early on when Christopher Wool’s untitled 1990 word painting spelling out “fool” (est. £2.5-3.5 million; $3.9-5.5 million) sold to a telephone bidder for £4,913,250 ($7.71 million), vanquishing Wool’s previous high-water mark of $5 million, set at Christie’s New York in May 2010. Not long after, a lush Gerhard Richter Abstraktes Bild from 1994 (est. £5-7 million; $7.9—11 million) soared to £9,897,250 ($15.5 million).

As Francis Outred, European head of postwar and contemporary art, notes, “People aren’t just buying the big-ticket items like Bacon and Richter. They’re buying masterpieces by less fashionable but equally important postwar artists.” He pointed to the success of Nicolas de Stael’s color- drenched seascape Agrigente, 1953 (est. £3.5-5 million; $5.5-7.9 million), which surged to £5,305,250 ($8,3 million).

Sotheby’s uptempo auction the next night lacked a blockbuster like the Bacon but saw a similarly strong result, with sell-through rates above 90 percent. Works by classic postwar European artists were in high demand, as Yves Klein’s body-print ANT 59, from 1960 (est. £450-650,000; $707,000-1 million), fetched £937,250 ($1.5 million). Last sold at Sotheby’s London in June 2009 for £457,150 ($707,000), the piece doubled its value in 32 months, another sure sign of a market recovery. Italian artists in particular drew intense interest, with at least five bidders going after Alberto Burri’s Nero plastica, 1965 (est. £800,000—1.2 million; $1.2—1.9 million), in torched black plastic on canvas. It was finally won by London’s Helly Nahmad Gallery for £2,057,250 ($3.2 million).

Two Zao Wou-ki abstracts stoked Asian bidding, with 28.12.99, from 1999 (est. 40o-700,000; $786,000-1.1 million), selling to a private collector on the telephone for £1.8 million ($2.9 million) and 13.01.91, from 1991 (est. £600-800,000; $943,000-1.3 million), going to another for £1.6 million ($2.5 million).

Gerhard Richter’s oil-on-canvas, Ice (Eis), 1981, achieved $6.8 million at Sotheby’s

But the serious money here was reserved for Richter, currently the most bankable living artist on the planet. Sotheby’s had half a dozen of his paintings on offer, overwhelmingly in the abstract mode, although it was Ice (Eis), 1981 (est. £2-3 million; $3.1-4.7 million), a photo-painting of icebergs reminiscent of Caspar David Friedrich, that fetched the number-two price of £4,297,250 ($6.8 million). The gray and white Abstraktes Bild (768-4), 1992. (est. £3-4 million; $4.7-6.3 million), resembling a copse of birch trees, garnered the evening’s top price of £4,857,250 ($7.6 million), paid by a private collector. Altogether, the six Richters brought in a whopping £17.6 million ($27.7 million), nearly 35 percent of the evening’s total.

Phillips closed out the series on February 16 with a small but successful event. Just two lots went unsold, and the total landed within the modest pre-sale estimate range of £5.1-7.6 million ($8-11.9 million). The top earner here was Lucio Fontana’s Concetto spaziale, Attese, 1960 (est. £1-1.5 million; $1.6-2.5 million), a slashed white canvas once owned by Andy Warhol, which took in £1,049,250 ($1.6 million). Warhol himself came in third, with a 1974 Mao painting (est. £300-500,000; $471-785,000), claimed by a telephone bidder for £457,250 ($718,000), just behind Rudolf Stingel, whose pattern-packed Untitled, 2004 (est. £450-650,000; $690-996,000), in oil and enamel on canvas, sold to a telephone bidder for £505,250 ($793,000). The highest-achieving of three guaranteed lots was Cindy Sherman’s cowgirl clown, Untitled #410, from 2003 (est. £200-300,000; $307-460,000), which four bidders contested to a final price of £433,250 ($680,000). Moments after the sale, Michael McGinnis, Phillips’s worldwide head of contemporary art, expressed satisfaction with the outcome, saying, “It’s exactly what we expected. We have a much better indication of what the mar- ket can absorb.”

Satisfaction, if not joy, seemed to be the lasting impression of the London sales. Amsterdam dealer Siebe Tettero described the Phillips sale as “a little tepid, but they did well, just as Sotheby’s did with what they had. I think Christie’s won this round.” The solid postings across the board, however, bode well for the May sales in New York.