Curated Selling Shows, Online Platforms, New Commission Strategies, Global Penetration: The Brick-and-Mortar Auction House Enters the 21st Century

Christie’s headquarters in London

In the wake of the now largely forgotten price-fixing scandal of woo, which saw Christie’s and Sotheby’s jointly shelling out $512 million in fines for charging sellers rigged nonnegotiable commissions, the first order of business for the houses was to find new ways to increase the scarce revenues from highly competitive auction sales. The most visible measure undertaken by the two auction giants was to intensify investment in the fast-emerging Asian marketplace.

Sotheby’s began holding sales in Hong Kong in 1973, and Christie’s by 1986, Both established frontier offices in Shanghai in the 1990s, staffing up those outposts with native-speaking specialists to woo newly minted elites. The action in Asia beefed up revenues for both houses, peaking in 2011 with $960 million in Hong Kong sales for Sotheby’s and $854 million for Christie’s. With the maturing of the market and a tightening of tax restrictions, the initial wild pace of growth slowed. HongKong totals at both houses fell in 2.012 to $595 million at Sotheby’s and $705.4 million at Christie’s.

Steve Murphy, CEO or Christie’s – “Being a good auctioneer means being a great advisor to clients.”

Hong Kong remains the auction capital of Asia, but the Beijing market is bubbling. Christie’s brokered an early licensing deal with the Forever International Auction Company, founded in 2005 to hold sales on the mainland under the Christie’s banner. Last year Sotheby’s sealed a 10 year joint venture with the state-owned Beijing Gehua Art Company to hold auctions within China. Still, the rise of formidable mainland-based competitors like China Guardian and Beijing Poly International Auction, aswell as inroads by the U.K.’s Bonhams, has the potential to erode profits. With the firstwave of expansion from Asia to the Persian Gulf States and Latin America largely accomplished by 2005 Christie’s and Sotheby’s returned to the drawing board to devise additional channels of profitability. The houses initiated the practice of private sales and gingerly tried on another hat: that of art dealer.

“We’ve spent a lot of time, energy, and money changing the way we provide a great experience for the collector, and that’s what drove us to private sales,” says William F. Ruprecht, the veteran president, CEO, and chairman of Sotheby’s. He characterizes the house’s approach to its customers as “high – touch, high-service” and explains the firm’s evolution: “People were asking us, ‘Do you know where I can get a so-and-so?’ or ‘If you ever hear about one of these, let me know.’ Every auction creates all this data, and most of the money goes home. It doesn’t get spent—the clients came, they bothered to participate, and they went home disappointed. What do you do with that? You create a lot of opportunities with private sales.”

“If I go to Sotheby’s now, I can choose to go through the public auction arena or use them as a private dealer,” says Oliver Chen, a specialty retail and luxury analyst at Citibank who tracks the performance of Sotheby’s, which is publicly traded. “In the past, they would have lost an opportunity to capture that revenue for themselves because the client just didn’t want to do the auction.”

Steven Murphy, who took the reins in 2011 as the first American CEO of Christie’s, describes his company’s march to private sales somewhat differently. “Christie’s has always been in the art advisory business, advising clients to sell or buy, and then having the transaction he the auction. Being a good auctioneer means being a great adviser to clients.” In recent years, he continues, “clients have evolved and migrated into activities for their own collecting and transacting, including auctions, art fairs, private sales, and, increasingly, online transactions. I believe what we need to be about is aligning ourselves with our clients’ art buying activity.”

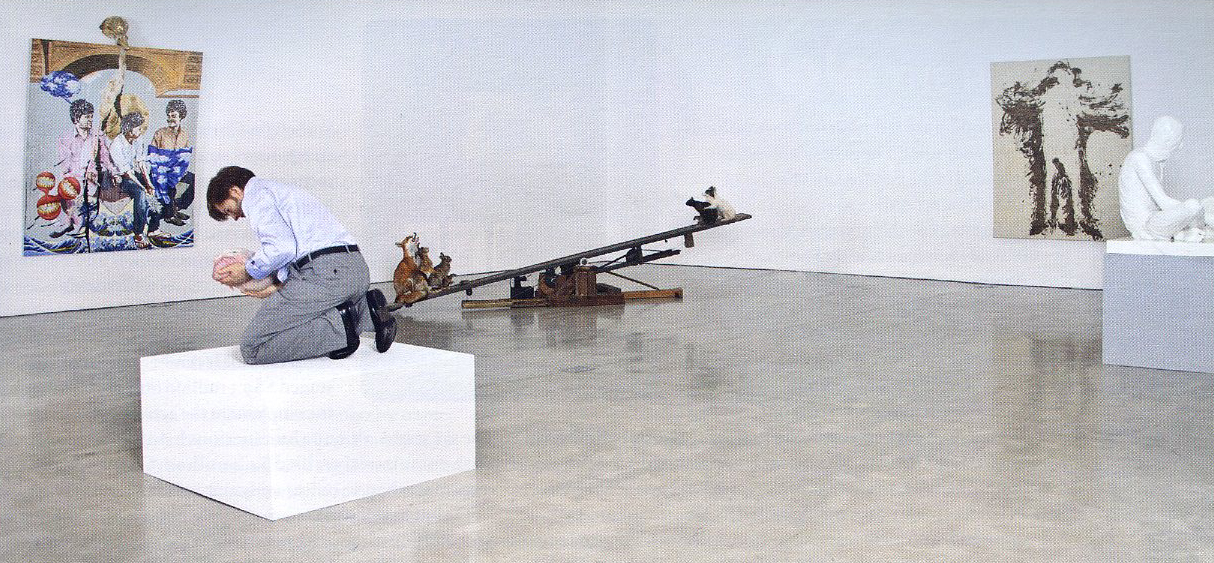

Christie’s purchased Haunch of Venison gallery in 2007. The 2011 exhibition “Boundaries Obscured,” above, inaugurated the Chelsea (New York) branch, which is closing this month as part of a reorganization. Works included, from left to right, a painting with bronze gargoyle by Jitish Kallat; mixed media sculptures by Patricia Piccinini and by Jake and Dinos Chapman; a figure drawn with ash, charcoal and glue on canvas by Gunther Uecker; and a marble figure by Kevin Francis Gray

To understand the magnitude of this shift, Christie’s reported $256 million in private sales in 2006, Sotheby’s $328 million. According to the houses, those numbers swelled to $809 and $815 million, respectively, in 2011. And the growth continues. Total private sales at Christie’s jumped 50 percent from 2010 to 2011 and 65 percent at Sotheby’s during the same period. By comparison, overall auction sales at Christie’s increased by a modest To percent during that period, and Sotheby’s registered a 14 percent increase. Auction totals for 2012 remain downbeat, with Sotheby’s falling 12 percent (to $4 billion) and Christie’s rising 7 percent (to $5.3 billion). Private-sale figures for zoiz were notavailable at press time, but both houses expected to reach the billion-dollar m ark. Though neither house breaks down private-sale activity bycategory,mostfalls in the areas of postwar and contemporary art, Impressionist and modern art, and, to a lesser extent, jewelry and Old Master paintings.

William F. Ruprecht, President, CEO and Chairman, Sotheby’s – “We’ve spent a lot of time, energy and money changing the way we provide a great experience.”

“The competition between the auction houses,” says David Nash of the New York gallery Mitchell-Innes & Nash and a former head of the Impressionist and modern department at Sotheby’s, “is so intense that they’ve eroded their commissions to really low levels. Private sales are much less competitive for the moment. I believe it will become more competitive when people realize they can play one auction house offthe other, but at the moment private sellers don’t really ask for proposals from both houses as they do for auction consignments.” According to Nash, “the impact of auction house private sales on dealers has been quite substantial. It makes it much harder for dealers to get things on consignment.”

Nash points to a nether problem, this one for the auction houses: “They are competing against themselves. How do they decide whether to put something in an auction or to sell it privately? I think their auction sales are weaker because they’re being undermined by private sales.”

“A lot of my former colleagues definitely perceived private sales as depleting the tree of future auction sales, ripping off some apples thatwould naturally be ripe for the auction world,” says Thoma s Seydoux, formerly the Europe-based chairman for Impressionist and modern art at Christie’s and now a partner in the recently formed private dealership Connery Pissarro Seydoux. “I told them if we don’t rip the apples offthe tree, somebody else will.”

According to Ruprecht, at Sotheby’s the decision to sell privately or through auction is thrashed about by staff. “The way we typically work,” he says, “is thar the same group of specialists—when they encounter an object—think about both channels and both ideas at the same time: `What’s going to work best for this object? What will work for this client?'” Ultimately the seller decides, and the determining factor may be risk tolerance. It can appear safer to sell privately rather than risk a buy-in at an auction or take the assurance of a third-party guara ntee at auction and forfeit some of the potential for realizing a higher price.

Going mobile: Christie’s free app for Mac and Android devices, top, offers information on hundreds of auctions, allows users to submit absentee bids, and teaches the uninitiated how to buy and sell at the auction house.

The houses’ embrace of private sales has caused turbulence among some of the specialists. Aside from year-end bonuses, specialists receive no commissions on properties they bring in for auction, while private sales often yield handsome commissions, understood to be as high as 10 percent of the net profit on a particular transaction. As Seydoux viewed his new mandate at Christie’s around 2007-08, “I always saw private sales as an additional arrow for my bow. I could seize opportunities in the private market that I couldn’t seize at auction, and it would give me a new argument bring to a client.” But he sees a big difference in the role played by the specialist-turned-salesman. “It’s the bond the salesman has with the buyer, to act as a buffer between the buyer, whomay be a Russian oligarch, and the vendor, who may be from the French bourgeoisie. You earn a commission by reconciling those opposite worlds.”

Mary Hoeveler – Art Advisor, “Sotheby’s has been the leader in coming up with the creative financial deals.”

The private-sale platforms for each house are multiple. After acquiring Haunch of Venison in 2007 from dealers Harry Blain and Graham Southern, Christies ran the wholly owned subsidiary as a stand-alone contemporary art gallery with two branches in London and one in New York. This month the house is reorganizing operations, closing the New York branch and ending artist representation to refocus on private sales. The gallery’s revenue is included in the private-sales figures of Christie’s, according to a company spokesman. Sotheby’s owns Maastricht-based Noortman Master Paintings, which runs a modest Old Bond Street office in London and was acquired in June 2006 with great but largely unfulfilled expectations. (Sotheby’s paid $56 million

in stock and assumed $26 million in debt.) Noortman focuses primarily on Old Masters and participates in Maastricht’s important European Fine ArtFair(TEFAF). It’s unclear how much of the $21.8 million Sotheby’s reported as “dealer sales” revenue in loll (down 2.5 percent from 2010) was delivered by Noortman, since that figure also includes revenue from sales involving financing deals between Sotheby’s and other galleries. The house’s “private sales” figures are reported separately.

Private sales have acquired a more public face with the auction houses’ introduction of curated selling shows. Early in zone, at its private-sale gallery near Rockefeller Center, Christie’s presented “A Tribute to Forrest Bess,” a single- owner sale (and a benefit to boot) timed to coincide with the artist’s inclusion in the Whitney Biennial. This was followed in October by a show of New York painting from the 1970s co-curated by Robert Pincus-Witten and Amy Cappellazzo, the chair of postwar and contemporary development at Christie’s. Both shows were accompanied by full-dress catalogues. With the aim of educating new audiences abroad, the Christie’s private sales arm, in conjunction with New York—based Adelson Galleries, organized “Andrew Wyeth in China,” which traveled to Beijing and Hong Kong before landing in New York.

In September 2011 Sotheby’s launched S2, a Richard Gluckman—designed gallery space in the company’s York Avenue headquarters. Devoted to independently curated selling shows, S2 has called upon Debra Burchett-Lere, director of the Sam Francis Foundation; the private dealer Josh Baer; and, in a concerted effort to draw a younger crowd, the ultra hip independent curator Vladimir Restoin Roitfeld.

Although other new sources of revenue do not approach the levels provided by Asian expansion and the rise of private sales, Sotheby’s, Christies, and their smaller competitors continue to explore new technological and financial models that might eventually become vital to the industry. As the field of e-commerce grows with online platforms like Paddle8, Artsy, VIP Art, and Artspace, Christie’s is fashioning its own online presence. For the high-profile sale of the Elizabeth Taylor collection in December win, the house staged a $9.5 million online-only auction to complement the action in the salesroom. The six stand-alone online auctions held by the house in 2012 cumulatively tallied $4.4 million. Christie’s plans to stage more than 30 online-only auctions in 2013.

Online auction pioneer Sotheby’s took a bath of more than $100 million in the pre-broadband era ofthe 1990s and no longer conducts Web-only sales. “We get important bids on high-value objects from the Web that have reached $2.0 million,” says Ruprecht of Sotheby’s, “but we’re not seeing the Web as a significant channel outside the live auction business. There are a lot of people attempting to do online sales but, at least today, none of them have any scale. Further, we have not seen low-value lot buyers from the Web move upstream to higher value transactions.”

By contrast, Greg Rohan, president of Dallas-based Heritage Auctions, asserts that “online business has been integral to our growth since our website went live in 1996.” Rohan claims that his site “enjoys twice as much traffic as the Christie’s and Sotheby’s sites combined. Right around 50 percent of our winning bids currently come from the Internet.”

At Sotheby’s, revenue-generating innovations tend to be financial rather than technological. Mary Hoeveler, a New York—based private art adviser, says, “Sotheby’s has been the leader incoming up with the creative financial deals and seems to work that angle more than Christie’s does.” She is referring in part to the introduction of so-called third-party guarantees that assure sellers of receiving a specific amount of money for apiece at auction by sourcing an outside party to guarantee the risk. This has largely replaced the direct financial guarantee of the auction house, which was deemed too risky following the global financial collapse of 2008. Both houses lost tens of millions of dollars in the fall of 2008 for placing those bad bets. The impact of third-party guarantees is difficult to gauge, though their popularity among risk- averse sellers is considerable. At the record-breaking $412.3 million postwar and contemporary sale at Christie’s last November, for example, 24 of the 73 lots offered, or 33 percent, carried third-party (8) or direct guarantees (16).

Some seasoned observers criticize the third-party guarantee. “This business of selling guarantees to third parties who are also allowed to bid on the properties they’ve guaranteed is a difficult issue,” Nash says. “Sotheby’s and Christie’s both say they make this practice perfectly clear and that they’ve had no complaints, but Iwould also say very few people really understand the system enough to complain.”

Philip Hofman, Founder and CEO, Fine Art Fund Group, “The Houses are perfectly entitled to be better remunerated if they make a huge price.”

In another move, last year Sotheby’s formally introduced “performance-related commissions” that reward the house if the hammer price of a lot exceeds its high estimate. Christie’s has yet to follow suit and declines to comment, but it’s rare that one arch rival doesn’t eventually mimic the other when it comes to financial maneuvers. Hoeveler questions the underlying validity of performance-related commissions, noting that “it obviously has inherent conflicts of interest because the auction house is setting the estimates and there’s an incentive for it to estimate conservatively.” Holding a contrary view, Philip Hoffman, the founder and chief executive of the London -based Fine Art Fund Group, says, “The houses are perfectly entitled to be better remunerated if they make a huge price. It’s not a crazy idea, and I’m not allergic to paying it.”

Not so new is the idea of cashing in on a venerable name, which has led Sotheby’s to some adventures in branding. In 1971, when the British firm was in dire financial straits,it briefly marketed Sotheby’s Special Reserve king-size cigarettes. Last year the house launched a less controversial product, champagne from R&L Legras bearing the Sotheby’s label, available online and at its retail wine shop on York Avenue in New York City. “Sotheby’s champagne,” according to Jamie Ritch ie, CEO of Sotheby’s wine in the U.S. and Asia, “is light, fresh, and elegant and is the sort of champagne you can drink all day and night.”

For all the new initiatives at Christie’s and Sotheby’s, a number of smaller auction houses remain determined to chip away at their hegemony. The boutique-scaled Phillips (recently shorn of its charismatic chairman Simon de Pury), enjoys a disproportionately high profile in the international auction landscape. The company runs a private-sale department as well, “We’re really embracing this new era at Phillips,” says Michael McGinnis, the firm’s recently named CEO. But even with plans for new departments and geographic expansion, Phillips faces a daunting challenge, especially as it attempts to penetrate the high end of the market, where profit margins are notoriously slim. “It’s incredibly difficult to break into that duopoly of Christie’s and Sotheby’s,” Hoffman says. “They’ve attracted the best experts that money can buy, they’ve got

huge departments and offices all over the world, they’ve got massive client reach from their historical records. Why would you sell a $5 million lot with the number-three auction house when you have the choice of number one or number two?”

For “Hong Kong Blooms in My Mind,” a private selling show of her works at Sotheby’s Hong Kong last May, the artist Yayoi Kusama decorated the hallway to the gallery, left, with her trademark dots.

Two mainland China enterprises, China Guardian, established in 1993, and Beijing Poly International Auction, incorporated in 2005, promise a different sort of growth and threat, since so much wealth resides in Asia today and more than a third of worldwide auction sales now occur there. “Little by little,” says Richard He, chief representative for North America at China Guardian’s New York office, “I th ink we will get market share.” In fact, China Guardian’s debut Hong Kong auction of modern Chinese paintings last October at the Mandarin Oriental Hotel made HK $455 million ($58.7 million), far above the presale estimate HK$185 million ($23.9 million)—helped, no doubt, by some Too VIP bidders flown from the mainland to Hong Kong courtesy of the house.

The advance of new competitors may affect the duopoly’s ability to maintain its sky-high commission structures. “When you have two main competitors, there are a lot more ways they can go down than up,” says George Sutton, chief research analyst for Minneapolis-based investment banking firm Craig-Hallum. He zeroes in on the vulnerability of commissions charged to sellers and buyers. “There is no one who would tell you they’re thrilled about the commission margins or the premiums they pay, compared with other businesses,” Sutton says. “Look at the stockmarket and the commission rates [for brokers] that have plummeted over the last io to 15 years. Is there any reason why you shouldn’t see a similar dynamic over time for the art auction market?”

That erosion of brokerage commissions, adds Sutton, was hastened by the rise of on line options and greater competition. Such a chilling scenario for the auction houses’ bottom lines will surely prompt further strategizing about newways to sustain—and raise—profitability in the coming years.